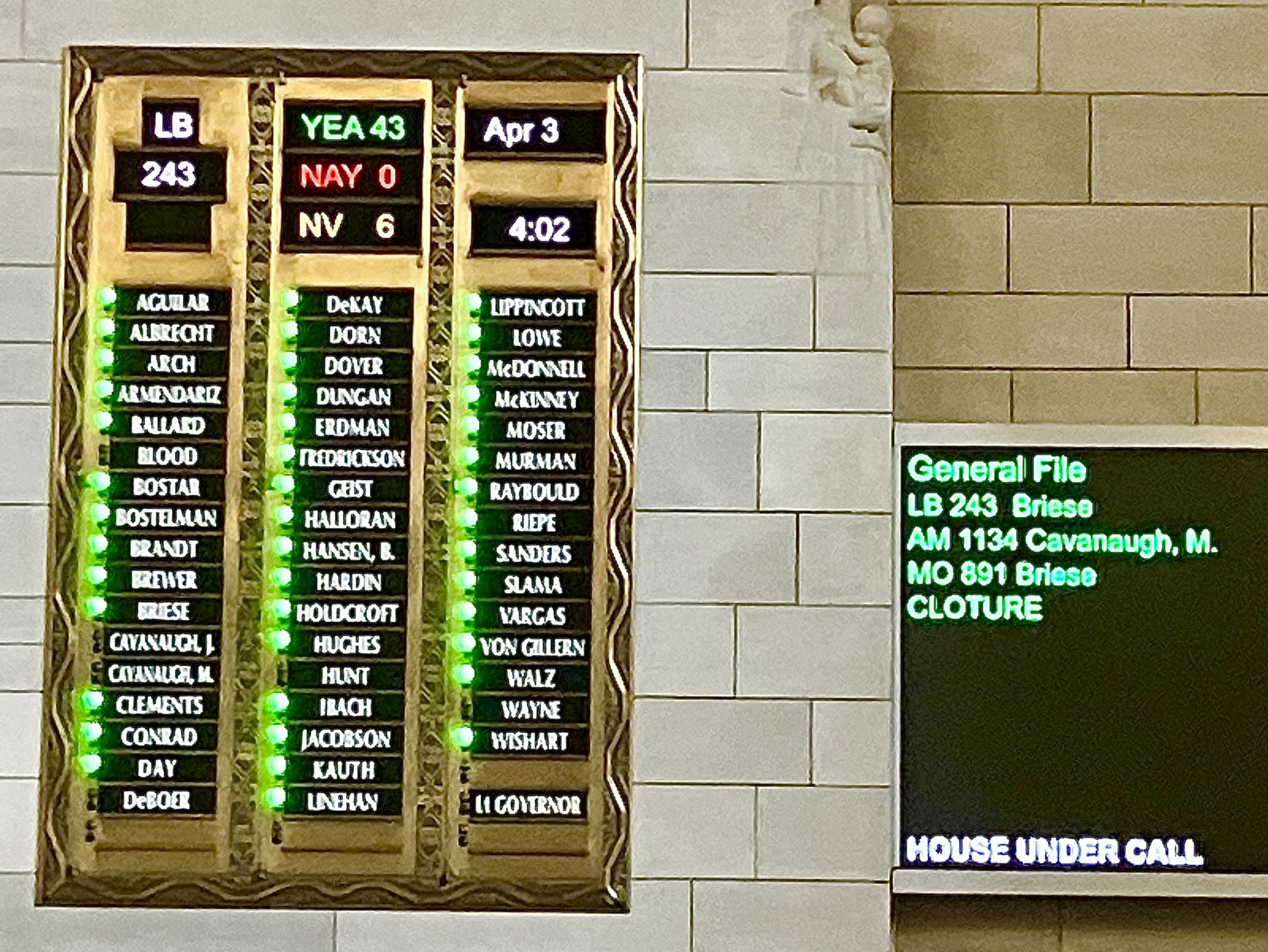

Lb 243 Nebraska 2025

Lb 243 Nebraska 2025 - NOTICE OF LB 243 at REGULAR MEETING September 11, 2025 Nebraska, (klkn) — senators voted monday to advance a key piece of what the pillen administration has called the largest package of tax cuts in state history. Lb 243, introduced by state sen. Lb 243 Nebraska 2025. Lb 243 boosts the property tax credit fund to $360 million next. Lb 243, as introduced by state sen.

NOTICE OF LB 243 at REGULAR MEETING September 11, 2025 Nebraska, (klkn) — senators voted monday to advance a key piece of what the pillen administration has called the largest package of tax cuts in state history. Lb 243, introduced by state sen.

Finally, lb 243 would end community colleges’ ability to levy property taxes, except for building needs, starting in 2025.

Nebraska 2025 Rankings Update Frontcourt Stock Risers Prep Dig, Again, senators also advanced a bill to give more property tax relief to nebraska homeowners. It would end state taxes on social security benefits by 2025, and it would provide a tax credit of up to $2,000 per child for families making under $75,000 a year,.

Senator Julie Slama on Twitter "Good news for Nebraska taxpayers! LB, Lb 243, as originally introduced by briese, would have increased the property tax credits now provided to land and home owners from the current $315 million in 2025 to $700 million by 2029. Lb 243 boosts the property tax credit fund to $360 million next.

Nebraska 2025 Rankings Update New Additions Prep Dig, Lb 243 would incrementally increase what the state sets aside to provide direct credits to land and home owners from the current $315 million to $388 million in. Tom briese of albion, will increase nebraska’s two property tax credit programs, cap school property tax growth and eliminate almost all.

Pending revenue adjustments based upon nebraska’s updated.

Nebraska 2025 Rankings Update Stock Risers Prep Dig, All three bills are working their way through. Tom briese of albion and amended by the revenue committee, would make a series of changes aimed at easing the financial impact of increasing property tax valuations.

Nebraska Husker Football Schedule 2025 Chargers Schedule 2025, For tax year 2025, nebraska taxes income at and above $37,130 for individuals and at and above $74,260 for married couples at its top income tax rate of. Lb 583 provides education funding.

Pending revenue adjustments based upon nebraska’s updated.

Lb 754 reduces the state's top personal tax rate and the corporate income tax rate to 3.99% by tax year.

Labomed, Inc. LB243 Biological Binocular Microscope with Infinite, Tom briese of albion and amended by the revenue committee, would make a series of changes aimed at easing the financial impact of increasing property tax valuations. Lb 243, as originally introduced by briese, would have increased the property tax credits now provided to land and home owners from the current $315 million in 2025 to $700 million by 2029.

Nebraska adds Northern Iowa to 2025 football schedule r/CFB, It would end state taxes on social security benefits by 2025, and it would provide a tax credit of up to $2,000 per child for families making under $75,000 a year,. Lb 243, as originally introduced by briese, would have increased the property tax credits now provided to land and home owners from the current $315 million in 2025 to $700 million by 2029.

Instead, the bill relies on a revenue cap passed last year as part of lb 243, a proposal from then sen. Under lb 243, the amount to be distributed would increase from $313 million this year to $560 million by tax year 2029, after which the credit total would grow by the same.

Nebraska Wild and Scenic 2025 Wall Calendar, Again, senators also advanced a bill to give more property tax relief to nebraska homeowners. Lb 754 reduces the state's top personal tax rate and the corporate income tax rate to 3.99% by tax year.

Senator Julie Slama on Twitter "Here’s a new one LB 243, which will, Tom briese of albion and amended by the revenue committee, would make a series of changes aimed at easing the financial impact of increasing property tax valuations. Tom briese of albion, will increase nebraska’s two property tax credit programs, cap school property tax growth and eliminate almost all.